Will My Heirs Need to Be Ready to Pay Estate Taxes?

I’m in my 80s and have a substantial sum in retirement accounts that I plan to leave to my children. Will they have to pay estate taxes on it?

Home » Retirement » Page 3

I’m in my 80s and have a substantial sum in retirement accounts that I plan to leave to my children. Will they have to pay estate taxes on it?

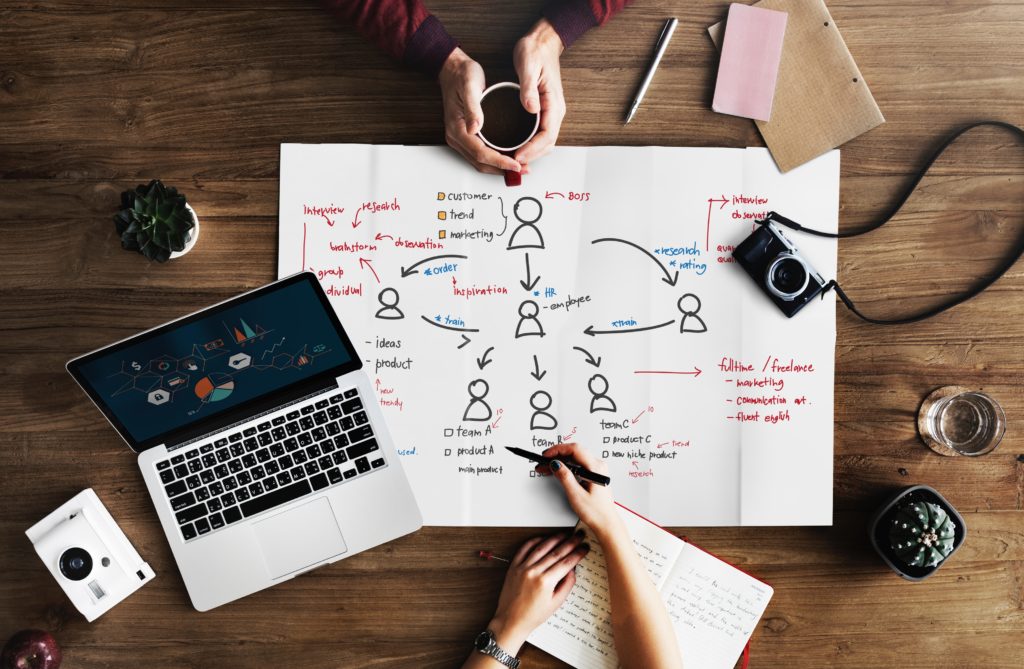

Going straight from a busy work life to ‘retired’ can be difficult, if you haven’t mapped out your path. Preparing yourself effectively involves both financial and lifestyle choices.

Retirees preparing to file their taxes for this year should be aware of a number of common pitfalls, often-overlooked deductions and changes that stem from the tax overhaul two years ago.

It’s been a big year for 50th birthdays. From Jennifer Aniston and JLo to Matthew McConaughey and Sean Coombs, it seems like everyone is having a milestone birthday in 2019. However, this isn’t really a big surprise, when you consider that in the Generation X (1965-1980) cohort, 1969 was one of the largest birth years.

The need for accuracy in assumptions applies not only to income and assets, but also longevity. As Gen Xers recognize that they may live longer than their Silent (1925-1944) or Boomer (1945-1964) parents, the longevity assumption could be the key to success.

If you have an individual retirement account, do you recall filling out a beneficiary designation form? That’s the document that allows you to direct the IRA custodian to transfer your IRA to the people you name in the form.

When Congress returns from recess, it will have a slew of proposals to consider, including some that could have a big impact on your retirement.

The transition to retirement means different things to different people, as does the actual age in which people turn the page to a new chapter in their life. Many factors contribute to this life-altering decision and many emotions are felt–everything from fear, stress and anxiety to the sheer excitement of being able to fulfill lifelong dreams.

Millions of Americans worry about saving enough for retirement, while also providing for their children’s future. However, most overlook another set of dependents who could cost them even more: their parents.

As a small business owner, you should be thinking about your succession plan. A succession plan—or exit plan—is the strategic transferring of management roles or ownership of the company to others, whether it be a family member, an employee or an outside party.

1067 N. Mason Road, Suite 3

St Louis, MO 63141

Copyright 2020 The Laiderman Law Firm, P.C. All Rights Reserved